|

||||

| |

||||

|

|

||||

|

This California bankruptcy law website will offer basic, general information about filing bankruptcy in California, including Chapter 7, Chapter 11, and Chapter 13 cases. It will address personal bankruptcy and corporate bankruptcy, liquidation, insolvency, reorganizations, debt consolidation, credit after bankruptcy, re-establishing credit, credit card debt, foreclosures, repossessions, and garnishments, taxes and bankruptcy, discharge of debts, as well as corporate bankruptcy involving asset liquidation and reorganization under Chapter 11. Bankruptcy is often misspelled as bankruptsy, bankrupsy, or bankrupcy, among other versions. The term "bankruptcy" itself is defined as being financially unable to pay one's debts as they become due, or to have more debts than assets. The word derives from a medieval term meaning "broken table". In towns where merchants sold their wares on tables, the table of a non-paying or defaulting merchant would be broken by those with whom he did business.

The Debtor Bankruptcy is also the statutory procedure under federal law by which a person, known as the "debtor" under goes a judicially-supervised liquidation or reorganization for the benefit of those who are owed money, known as "creditors", where the debtor is usually relieved of most of his debts through what is called "discharge". The debtor's property becomes what is called "the bankruptcy estate". This federal law is commonly known as "the Bankruptcy Code". Bankruptcy filings are all done in federal court, thus ensuring uniformity throughout the United States. Certain variations do occur from state to state relating to what assets an individual debtor is allowed to keep ("exemptions"), and as to the nature and extent of a debtor's property interests and other matters. Therefore, debtors should consult a local bankruptcy attorney to ensure the best representation.

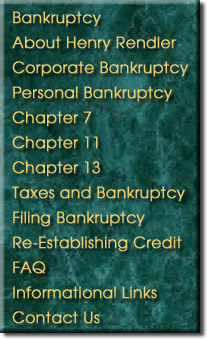

Voluntary Bankruptcy The vast majority of cases are filed voluntarily by the debtor. However, creditors are permitted to file involuntary bankruptcy cases against a debtor who is generally not paying his debts as they become due. These types of cases are much rarer. They require 3 or more petitioning creditors who are owed a total of at least $10,000.00; if there are less than 12 creditors in total, then the involuntary petition may be filed by one creditor who is owed at least $10,000.00. Bankruptcy Law The above information will be divided into the following categories:

Please Note: The materials on this site are informational only, of course, and are not guaranteed to be correct, complete, or up-to-date. The within information is not intended to give legal advice upon which you can rely for your particular situation. If legal advice or other expert assistance is required, the services of a competent professional person should be sought. Links to any other Internet pages are not meant to imply any affiliation. Henry Rendler has attempted to comply with all known legal and ethical requirements in compiling this website. Written by Henry Rendler, Attorney at Law in California |

|

|||

|

|

||||